- All insurance carriers that provide the primary layer of medical professional liability coverage for healthcare providers in the Patient’s Compensation Fund (PCF) must be licensed and admitted in New Mexico by the Office of Superintendent of Insurance or be a licensed risk retention group. Carriers must provide coverage on occurrence policies at limits prescribed by the New Mexico Medical Malpractice Act. Claims-made policies with indefinite tail coverage are also permitted for hospitals.

- Admitted carriers and risk retention groups that want to become primary layer carriers in the PCF must apply for approval by:

Submitting a copy of the occurrence policy form(s) that they will be using, including the SERFF filing number(s) showing prior approval of those forms and rates, to the PCF Administrator. The rates and forms used for the primary layer of medical professional liability coverage are subject to prior approval. Agreeing to continue to provide legal defense through settlement for claims that enter the excess PCF layer of coverage. - ISO physician/surgeon specialty codes must be used. The mapping of those ISO codes to PCF rating classes is provided below.

- All entities (rate class, 51, 52 and 53) must have at least one underlying qualified healthcare provider.

- The surcharge for entities will be 10% of the cumulative surcharge assessed to the individual QHPs that practice in the entity beginning March 1, 2020.

- All PCF-eligible QHPs employed by the entity must be enrolled in the PCF for the entity to be eligible for PCF coverage. This includes solo corps, they will have to obtain underlying coverage and pay applicable PCF surcharges.

- A healthcare provider must pay the surcharge to their primary insurer within 30 days of the effective date of coverage. The insurance carrier then has an additional 30 days to remit the PCF surcharge to the PCF.

- Compute surcharges for part-time health care providers on the same pro-rata basis as the underlying coverage.

- Slot coverage is not accepted in the New Mexico Patient’s Compensation Fund. Definition of slot coverage: Slot coverage is coverage for more than one part-time health care provider on a “full-time equivalency” (FTE) basis. This means that the premium for the “slot” is based on how many hours, collectively, the part-time health care providers will be working during the period of coverage. The premium for that slot would be comparable to one full-time health care provider’s premium. This is not allowed in the PCF. Limits cannot be shared. The fund does, however, allow coverage for part-time health care providers. Each of these health care providers will have to be enrolled individually, paying the class rate according to their specialty, on a pro rata basis.

- Policy end dates are set to terminate at 12:01 a.m. Coverage only exists up to the expiration date, not through the expiration date. A policy cannot be submitted for longer than a period of a year, 365/366 depending on leap year. All coverage shall expire at the end of December 31 of the year of admission or renewal.

- Cancellations: In accordance with the Superintendent’s regulations, a health care provider’s admission to the PCF will be terminated:

- on the date that the provider’s insurance coverage is canceled;

- on the date that the provider fails to provide additional security for financial responsibility when existing financial responsibility is impaired;

- on the date that the provider’s license, certification, or registration is suspended or revoked;

- on the date that the provider ceases to be a health care provider as defined by the MMA or the Superintendent’s regulations;

- on the date that the provider otherwise ceases to be eligible for admission to the PCF.

As required by the regulations, termination is effective as of the dates of the above occurrences, even if that date is before the PCF learns of the occurrence.

Admission may also be terminated if the provider does not timely respond to a request from the third-party administrator for a report, information, or data, as further described in NMAC 13.21.2.16(B).

The above listing is a summary of the regulations at NMAC 13.21.2.16. Please refer to the regulations for more details. In the event of a conflict between this summary and the regulations, the regulations control.

- Carriers must upload coverage reports via the PCF Administration Application, which uploads using a batch process with an Excel template which is provided. For additional support using the batch upload contact our PCF Support Team.

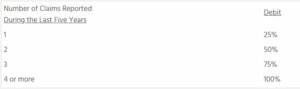

Include only those claims which resulted in at least one of the following conditions:

- A finding of both negligence and injury by the PCF medical review commission

- A claim settlement requiring payment by the PCF

- A trial judgment in favor of the plaintiff

* Do not report as a claim any incident that is overturned or dismissed with no monetary exchange.

Carriers are responsible for maintaining a repository of claim information in sufficient detail for them to calculate accurate debits. This may require carriers to expand their policy application questionnaires and procedures for obtaining information on claims incurred under prior carriers or in other states.

Rate Classes and Base Surcharges Effective January 1, 2026 (Click for PDF)

Rate Classes and Base Surcharges Effective January 1, 2025 (Click for PDF)

Rate Classes and Base Surcharges Effective January 1, 2024 (Click for PDF)

Rate Classes and Base Surcharges Effective January 1, 2023 (Click for PDF)

Rate Classes and Base Surcharges Effective January 1, 2022 (Click for PDF)

QHP Facility Rating – Hospitals

Click here to download QHP Facility Rating Spreadsheet for Hospitals 2026

Click here to download QHP Facility Rating Spreadsheet for Hospitals 2025

Click here to download QHP Facility Rating Spreadsheet for Hospitals 2024

Click here to download QHP Facility Rating Spreadsheet 2023

Click here to download QHP Facility Rating Spreadsheet 2022

QHP Facility Rating – Independent Outpatient Healthcare Facilities (OHCF)

Click here to download QHP Facility Rating Spreadsheet for OHCF 2026

Click here to download QHP Facility Rating Spreadsheet for OHCF 2025

Click here to download QHP Facility Rating Spreadsheet for OHCF 2024